A Biased View of Dubai Company Expert Services

Wiki Article

Some Ideas on Dubai Company Expert Services You Should Know

Table of ContentsUnknown Facts About Dubai Company Expert ServicesDubai Company Expert Services Fundamentals ExplainedDubai Company Expert Services Fundamentals ExplainedThe Single Strategy To Use For Dubai Company Expert ServicesDubai Company Expert Services Fundamentals ExplainedDubai Company Expert Services Can Be Fun For EveryoneThe smart Trick of Dubai Company Expert Services That Nobody is Discussing

The revenue tax rate is 0-17%. The personal revenue tax rate is also reduced as contrasted to other countries. The personal revenue tax obligation rate is 0-20%. Among the largest benefits of signing up a firm in Singapore is that you are not called for to pay taxes on resources gains. Returns are likewise tax-free below.

It is simple to begin business from Singapore to throughout the world.

The start-ups acknowledged with the Startup India campaign are supplied enough benefits for beginning their own organization in India. According to the Startup India Action strategy, the followings conditions have to be satisfied in order to be qualified as Startup: Being integrated or registered in India as much as one decade from its date of unification.

All about Dubai Company Expert Services

100 crore. The federal government of India has released a mobile application and also a site for very easy registration for start-ups. Anybody curious about setting up a startup can fill out a on the site as well as upload particular documents. The entire process is completely online. The government also supplies listings of facilitators of licenses as well as trademarks.The government will bear all facilitator costs and the start-up will bear just the statutory fees. They will take pleasure in 80% A is set-up by federal government to give funds to the start-ups as endeavor resources. The government is also giving guarantee to the loan providers to encourage financial institutions and also various other economic institutions for offering equity capital.

This will help start-ups to draw in more investors. Hereafter plan, the startups will certainly have a choice to select between the VCs, providing the liberty to choose their capitalists. In situation of exit A start-up can close its business within 90 days from the day of application of winding up The government has actually suggested to hold 2 start-up fests annually both across the country as well as internationally to make it possible for the different stakeholders of a startup to fulfill.

Excitement About Dubai Company Expert Services

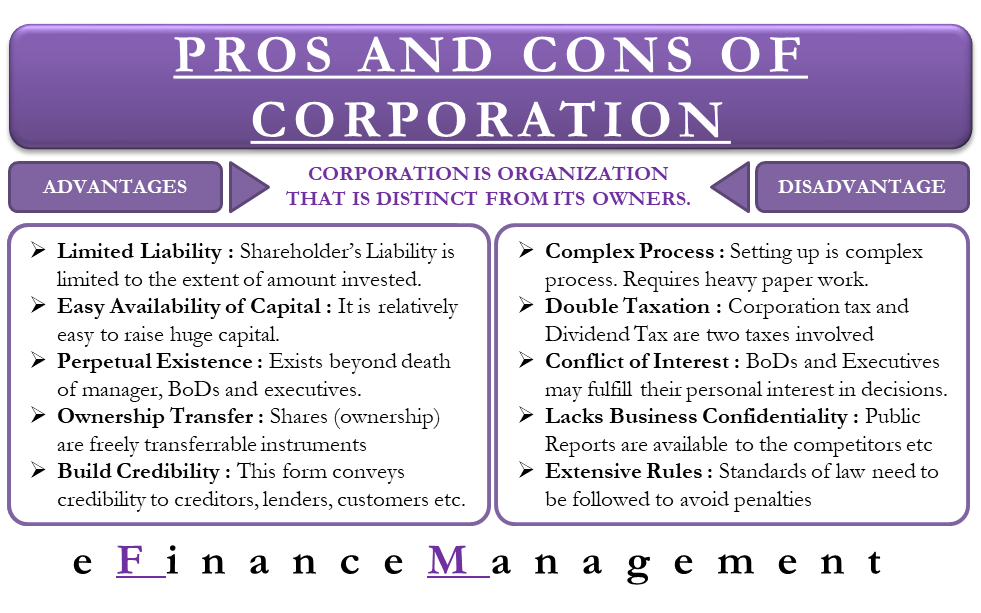

Minimal companies can be a fantastic option for many building investors however they're not right for everyone. Some property managers may in fact be much better off having property in their personal name. We'll cover the pros as well as disadvantages of minimal firms, to aid you decide if a restricted business is the right alternative for your property investment business.As a firm director, you have the flexibility to choose what to do with the revenues. You can purchase additional residential properties, conserve right into a tax-efficient pension plan or pay out the revenue tactically making use of rewards. This adaptability can aid with your personal tax planning compared to personally owned homes. You can find out more regarding tax for building capitalists in our expert-authored overview, Intro to Residential Property Tax Obligation.

In which case, Section 24 would influence your profits. If your earnings are going up, this is certainly something you ought to maintain a close eye on and you might wish to think about a limited business. There find out here now are extra legal as well as monetary duties to consider. As a supervisor of a company, you'll lawfully be needed to maintain exact company and also economic documents and also send the appropriate accounts as well as returns to Firms Residence and HMRC.

Excitement About Dubai Company Expert Services

That's precisely what we do right here at Provestor: we're a You'll require to budget plan around 1000 a year for a limited business accountant and see to it that the tax benefits of a restricted company exceed this additional cost. Something that not lots of individuals speak concerning is dual taxes. In a limited company, you pay firm her comment is here tax on your revenues. Dubai Company Expert Services.It's worth finding an expert limited company home loan broker that can locate the finest offer for you. Grind the numbers or chat to a specialist to make certain that the tax savings surpass the additional expenses of a restricted firm.

A private restricted business is a sort of firm that has actually limited responsibility and shares that are not freely transferable. The proprietors' or members' assets are therefore protected in case of business failure. Still, it must be stressed, this protection only puts on their shareholdings - any money owed by the business remains.

Some Ideas on Dubai Company Expert Services You Should Know

Nevertheless, one major drawback for brand-new businesses is that establishing a personal restricted firm can be complicated and pricey. To shield themselves from obligation, firms have to stick to certain procedures when incorporating, including filing short articles of organization with Companies Home within 2 week of consolidation as well as the yearly confirmation statement.

The most common are Sole Trader, Collaboration, and Private Restricted Firm. Limited Responsibility The most substantial advantage of an exclusive restricted company is that the proprietors have restricted obligation - Dubai Company Expert Services.

If the firm goes insolvent, the proprietors are just accountable for the amount they have actually purchased the company. Any kind of company's cash stays with the business and also does not drop on the proprietors' shoulders. This can be a substantial benefit for new services as it shields their possessions from potential business failures.

What Does Dubai Company Expert Services Do?

Tax Effective Private restricted firms are tax reliable as they can claim company tax alleviation on their profits. In enhancement, there are several various other tax benefits offered to companies, such as resources allowances as well as R&D tax obligation credit scores.

This indicates that the business can acquire with other services as well as individuals and is liable for its debts. The only money that can be claimed straight in the firm's commitments and also not those sustained by its owners on behalf of the company is shareholders.

This can be practical for small companies that do not have the official website moment or sources to take care of all the management jobs themselves. Flexible Monitoring Framework Exclusive restricted business are well-known for sole investors or small companies that do not have the sources to establish up a public limited company. This can be advantageous for companies that intend to keep control of their procedures within a tiny group of people.

Dubai Company Expert Services - The Facts

This is because private restricted companies are a lot more trustworthy and also well-known than single investors or partnerships. In enhancement, personal restricted business usually have their internet site as well as letterhead, providing consumers and providers a sense of count on in the organization. Protection From Creditors As pointed out previously, one of the crucial advantages of an exclusive limited business is that it supplies protection from financial institutions.If the company goes right into debt or insolvency, financial institutions can not look for direct settlement from the personal possessions of the organization's proprietors. This can be important defense for the shareholders and also supervisors as it limits their obligation. This suggests that if the company goes bankrupt, the proprietors are not directly accountable for any kind of cash owed by the firm.

Report this wiki page